What will happen to your multi-owner business if one of the owners dies?

The sudden death of one of your business owners will likely have a devastating impact on your business, your employees, and the other owners of the business. It may also have a significant financial impact on a business owner's family. A properly structured business continuation plan (using a buy-sell agreement funded with life insurance) may help minimize the effect of a loss.

Why a continuation plan is important

Without a properly structured business continuation plan, the sudden death of one of the owners of your multi-owner business can:

-

Severely hinder your business' operations.

-

Leave the deceased owner’s family without its primary source of income.

-

Leave the deceased owner’s shares without a resale market.

-

Create a conflict between the remaining owners and the deceased owner’s estate regarding the future direction and ownership of the business.

-

Leave the business or remaining shareholders who desire to buy the deceased owner's shares without an agreed-on price or the available funds to complete the transaction.

The downside of waiting

Postponing the implementation of a business continuation plan can have unintended consequences. For example:

-

The insurability of one or more of the business owners can change, making the life insurance premiums more expensive, or worse, making life insurance unobtainable.

-

The nature of the business may change, making implementation of a business continuation plan impractical.

-

A business owner’s personal life may change, keeping him or her from entering into a business continuation plan.

The upside of a properly designed plan

Confirming your goals

A properly structured business continuation plan will help you answer the question of what happens to your business after the death of one of the owners. A business continuation plan generally will require:

-

a departing or a deceased owner’s estate to sell, and

-

the business or surviving co-owner(s) to buy the departing or deceased owner's interest in the business at an agreed-on price.

A well-designed business continuation plan also will provide:

-

continuity in business management,

-

a source of income for a deceased owner’s family, and

-

a clear direction for future ownership of the business.

Additionally, a business continuation plan may establish the value of the business for the buy-sell agreement and for estate tax purposes.1

Three ways to structure your plan

A business continuation/buy-sell plan for multiple owners is usually structured in one of three ways, according to who purchases the business interest:

-

With an entity redemption plan (also known as a stock redemption plan), the business purchases the business interest.

-

With a cross purchase plan, the remaining co-business owner(s) purchase it.

-

With a wait-and-see buy-sell plan, both the business and the co-business owners may have the opportunity to purchase the business interest.

How life insurance is used to fund your business continuation plan

The implementation of a business continuation plan using life insurance is often quite simple. With the assistance of your tax, legal and financial advisors, the owners of your business will choose which buy-sell structure is most appropriate for their needs.

Your attorney then drafts a buy-sell agreement which contains the parameters for the arrangement, including:

-

the possible triggering events for the buy-sell (e.g., death, disability, retirement, etc.) and

-

how the purchase price will be determined.

The parties involved in your buy-sell agreement will then purchase life insurance (ideally cash value life insurance) on each business owner’s life through a life insurance professional.

-

If the arrangement is structured as an entity redemption, the business will generally be the owner and beneficiary of the life insurance policies.

-

If the arrangement is structured as a cross purchase or a wait-and-see buy-sell, the co-business owners will generally be the owner and beneficiary of the life insurance policies.

When the business owner dies, the beneficiary of the life insurance policy can use the death benefit proceeds to purchase the deceased owner’s interest in the business as outlined in the business continuation plan.

The potential benefits of having an insured plan

A properly structured business continuation plan that includes life insurance can provide:

-

Continuity of ownership.

-

A source of income for a deceased business owner’s family.

-

A ready market for often non-marketable business interests.

-

Liquidity to a deceased individual’s estate for estate taxes and administration costs.

-

A fair valuation of the business interest for federal estate tax purposes.1

-

A fair return to a departing owner or a deceased owner's estate for his or her business interest.

An important note on IRC Section 101 (j)

Policies purchased to fund an entity redemption or wait-and-see buy-sell plan may be required to meet IRC Section 101(j) requirements on employer-owned life insurance in order for the policies to retain their tax-free* death benefits.

It is the employer’s responsibility to determine whether life insurance policies will be subject to IRC Section 101(j) and ensure compliance with its requirements. Of particular concern when structuring a business continuation plan is IRC Section 101(j)’s notice and consent requirement.

Prior to issuing the policy, the business must provide the proposed insured with a written notice that states:

-

That the business will be the beneficiary of the policy and may remain so even after the proposed insured is no longer with the business.

-

The maximum amount of life insurance that the business will purchase on the proposed insured.

The proposed insured must then consent in writing that the employer may purchase life insurance on his or her life. It is important to note that unless the notice and consent requirement is met prior to the policy issue date, the majority, if not all, of the policy’s death benefit will be subject to income tax.

Cash value life insurance provides added benefits

While using term life insurance to fund a business continuation plan may suffice in some arrangements, cash value life insurance policies are often a more appropriate funding mechanism for buy-sell agreements.

While a term policy may be less expensive in the early years of the arrangement, term insurance only provides funding in the event of one contingency – the death of the insured – and does not help if an owner is departing or retiring from the business.

Cash value life insurance policies may provide the parties in a buy-sell agreement with the following benefits when compared to term life insurance:

-

The cash value of the policy may be used as part of a lifetime buyout. Often, a buy-sell occurs for a reason other than the death of a business owner (e.g., retirement, disability, or a specified date). The policyowner may use any available cash value in the life insurance policy to pay for part of the buyout price or as a down payment towards an installment buyout.

-

The insured(s) may not have to requalify for insurance. At the end of a fixed duration/level premium term life insurance policy, rates may increase dramatically. At this point the purchase of a new term life insurance policy may be cost prohibitive.

-

If the arrangement is an entity redemption, the business may book the policy cash value as an asset and may access any available policy cash value for emergencies or other financial needs.

-

If the arrangement is a cross purchase or wait-and-see buy-sell, the policyowners/business owners may access any available cash value for emergencies or other financial needs.

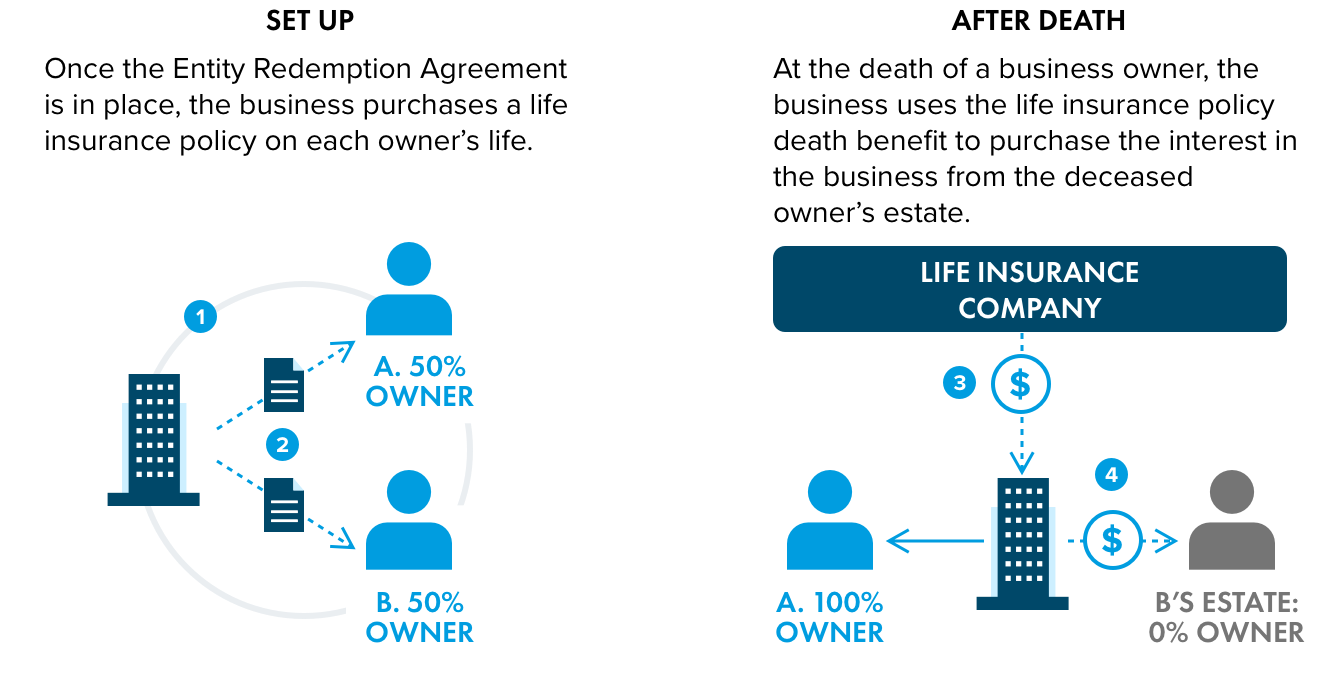

Entity Redemption

50% ownership is for illustrative purposes only.

1

Agreement

Working with the business’ legal, tax and financial advisors, the business owner(s) and the business enter into an entity redemption agreement. The agreement requires the business to purchase the business owner’s interest in the business for an agreed-on price when a triggering event occurs (e.g., death, retirement, or disability).

2

Life Insurance

To fund the purchase of each owner’s interest, the business will buy a life insurance policy through a life insurance professional on each business owner’s life. Prior to issuing the policy, the business must provide written notice to the business owners according to IRS requirements and receive their written consent to the life insurance purchase. The business will pay the policy premiums and will be the policy beneficiary.

3

Death Benefit

At the business owner’s death, the business will receive the life insurance death benefit income tax-free.*

4

Purchase of Business Interest

The business will apply the death benefit proceeds towards the purchase of the deceased business owner’s interest in the business from the estate.

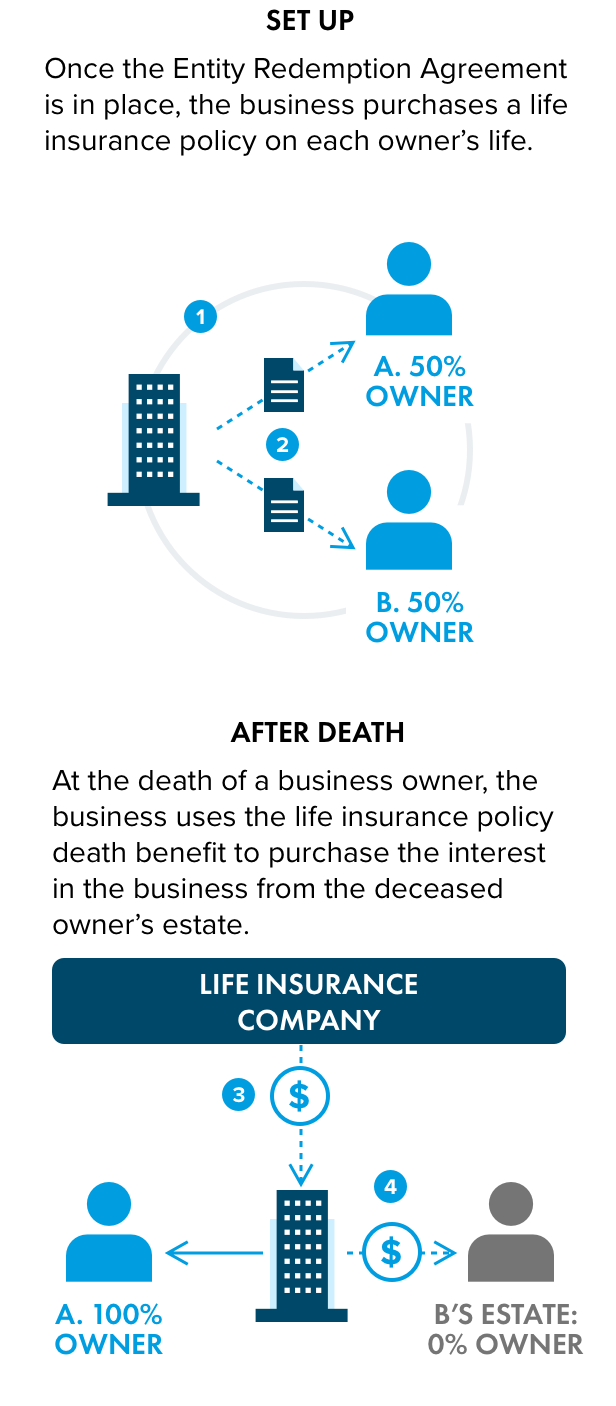

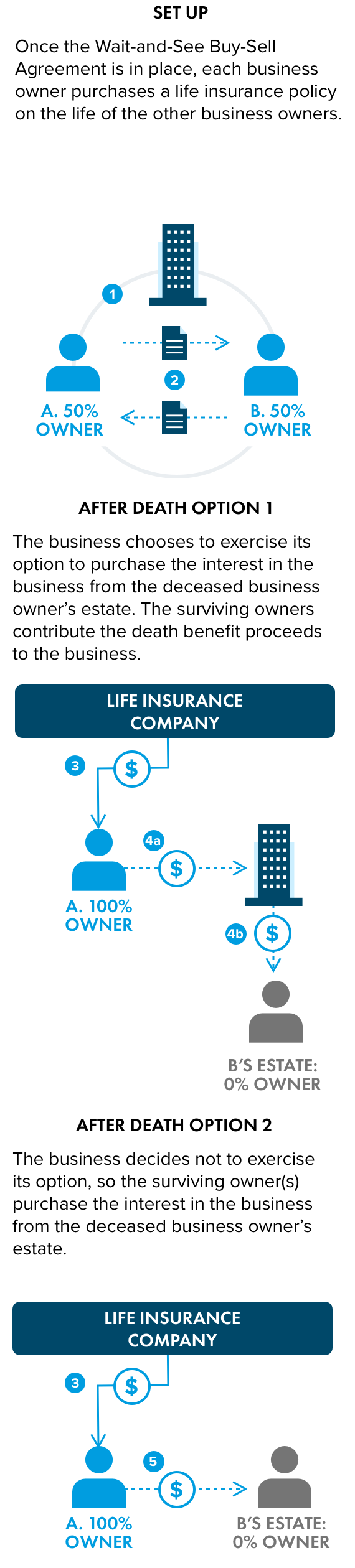

Wait-and-See Buy-Sell

50% ownership is for illustrative purposes only.

1

Agreement

Working with the business’ legal, tax and financial advisors, the business and the business owners enter into a wait-and-see buy-sell agreement. The agreement will give the business the first option to purchase a business owner’s interest when a triggering event occurs (e.g., death, retirement, or disability). If the business does not exercise its option, the co-business owners will have an option to purchase the departing or deceased business owner’s interest. If the co-business owners do not exercise their option, generally the business will be required to purchase the departing or deceased business owner’s interest in the business.

2

Life Insurance

To fund the purchase of each business owner’s interest, the business owners will purchase a life insurance policy (or policies) through a life insurance professional on the lives of the other participating business owners. The policyowner will pay the policy premiums and will be the policy beneficiary.

3

Death Benefit

At a business owner’s death, the surviving owner(s) will receive the life insurance death benefit income tax-free.*

4a

Capital Contribution or Loan

If the business decides to exercise its option to purchase the deceased owner's interest in the business, the co-business owners may contribute the death benefit proceeds they receive to the business as a capital contribution or a loan.

4b

Purchase of Business Interest

The business will apply the business owner’s contributions towards the purchase of the deceased business owner’s interest in the business from the estate.

5

Purchase of Business Interest

If the business decides not to exercise its purchase option, the co-business owner may exercise theirs. If so, the co-business owner will apply the death benefit proceeds towards the purchase of the deceased business owner’s interest in the business from their estate.

Considerations

Entity Redemptions Structure

Advantages Include

-

A simple design because only one policy is required per business owner.

-

The business pays the life insurance premiums.

-

The business may carry the life insurance cash value on its books as an asset.

-

The business may access any available policy cash value through loans and withdrawals up to basis potentially income tax-free.2

-

Allows the business entity to be the owner and beneficiary of the policy if business owners are uncomfortable with other business owners purchasing and maintaining life insurance on their lives.

Disadvantages Include

-

An entity redemption may not provide an increase in basis for the remaining business owners.

-

Creditors of the business may make claims against the life insurance policy cash value.

-

The life insurance premiums are not a deductible expense.

-

In certain situations involving owners of C corporations who are related, due to the potential application of the family attribution rules, the sale may not qualify for sale and exchange treatment.

Cross Purchase Structure

Advantages Include

-

The purchasing business owner(s) may receive an increase in their basis in the business equal to the purchase price of the business interest.

-

Creditors of the business may not have the ability to make claims against the cash value of the individually owned policies.

Disadvantages Include

-

Multiple policies may be needed, because a cross purchase will generally require that a business owner buy a policy on each of the other business owners participating in the cross purchase.

-

The business owners will make the premium payments.

-

The cash value of policies owned on other business owners may be included in a deceased business owner’s estate.

Wait-and-See Buy-Sell Structure

Advantages Include

-

Flexibility in the structure of the buyout.

-

May provide the remaining business owners with an increase in their basis in the business.

Disadvantages Include

-

More complex implementation than with an entity redemption or a cross purchase structure.

-

The purchase of multiple policies by each of the business owners participating in the arrangement.

-

The business owners will make the premium payments.

-

The cash value of policies owned on other business owners may be included in a deceased business owner's estate.

For more detailed information on this and other business planning and preservation solutions, please contact your local M Financial Advisor.

Contributor

About Pacific Life

Pacific Life provides a variety of products and services designed to help individuals and businesses in the retail, institutional, workplace benefits, and reinsurance markets achieve financial security. Whether your goal is to protect loved ones or grow your assets for retirement, Pacific Life offers innovative life insurance and annuity solutions, as well as mutual funds, that provide value and financial security for current and future generations. Supporting our policyholders for more than 150 years, Pacific Life is a Fortune 500 company headquartered in Newport Beach, California. For additional company information, including current financial strength ratings, visit www.PacificLife.com.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products.

Pacific Life, its affiliates, their distributors and respective representatives do not provide tax, accounting or legal advice. Any taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or attorney.

Pacific Life Insurance Company is licensed to issue insurance products in all states except New York. Product/material availability and features may vary by state.

Insurance products and their guarantees, including optional benefits and any crediting rates, are backed by the financial strength and claims paying ability of the issuing insurance company. Look to the strength of the life insurance company with regard to such guarantees as these guarantees are not backed by the broker dealer, insurance agency, or their affiliates from which products are purchased. Neither these entities nor their representatives make any representation or assurance regarding the claims paying ability of the life insurance company.

Pacific Life Insurance Company is not an affiliated company of M Financial.

Pacific Life Insurance Company’s home office is located in Omaha, Nebraska.

* For federal income tax purposes, life insurance death benefits generally pay income tax-free to beneficiaries pursuant to IRC Sec. 101(a)(1). In certain situations, however, life insurance death benefits may be partially or wholly taxable. Situations include, but are not limited to: the transfer of a life insurance policy for valuable consideration unless the transfer qualifies for an exception under IRC Sec. 101(a)(2)(i.e. the “transfer-for-value rule”); arrangements that lack an insurable interest based on state law; and an employer- owned policy unless the policy qualifies for an exception under IRC Sec. 101(j).

1 Under the Tax Cuts and Jobs Act, the federal estate tax exemption starting after 2017 was $10 million per person (indexed for inflation effective for tax years after 2011) and the maximum tax rate is 40%; the indexed amount in 2023 is $12.92 million. In 2026, the federal estate tax exemption amount is scheduled to revert to $5 million per person (indexed for inflation for tax years after 2011).

2 For federal income tax purposes, tax-free income assumes, among other things: (1) withdrawals do not exceed tax basis (generally, premiums paid less prior withdrawals); (2) policy remains in force until death (any outstanding policy debt at time of lapse or surrender that exceeds the tax basis will be subject to tax); (3) withdrawals taken during the first 15 policy years do not cause, occur at the time of, or during the two years prior to, any reduction in benefits; and (4) the policy does not become a modified endowment contract. See IRC §§ 72, 7702(f)(7)(B), 7702A. Any policy withdrawals, loans and loan interest will reduce policy values and may reduce benefits.

Neither M Financial nor its insurance advisers/agents are authorized to give tax, legal, or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

An insurance policies financial guarantees are subject to the claims-paying ability of the issuing insurance company.

3480561.3 (2/26)

22-307A